Introduction

This time, we’ve harnessed the power of logistic regression and Streamlit to develop a sophisticated decision support system for HELOC (Home Equity Line of Credit) applications. This system is designed to transform the way financial institutions assess and manage lending risks, enhancing both accuracy and process efficiency.

The Challenge

Traditional HELOC risk assessments often rely on outdated methods that do not account for dynamic market conditions or individual borrower situations effectively. Our goal was to create a more adaptive, real-time solution that could seamlessly integrate into existing financial frameworks to provide accurate, actionable insights for non tech-savvy staff.

Model Training

We initiated the process with the following key steps:

- Data Preparation: Using

Pandas, we loaded and preprocessed a comprehensive dataset, ensuring that each variable was correctly formatted. This included handling missing values and encoding categorical variables for model readiness. - Feature Engineering: We conducted extensive exploratory data analysis to identify the most predictive features related to HELOC risk. This involved aggregating data by external risk estimates and analyzing the distribution in relation to the probability of defaulting.

- Training and Validation Split: We utilized

train_test_splitfromScikit-learnto divide the data into training and test sets, maintaining 80% of the data for training to ensure robust learning and 20% for testing to evaluate model performance.

Model Selection

Our selection criteria focused on simplicity and interpretability, essential for stakeholder trust and regulatory compliance:

- Logistic Regression Implementation: We implemented a logistic regression model using Scikit-learn, fine-tuning it to optimize for both accuracy and interpretability.

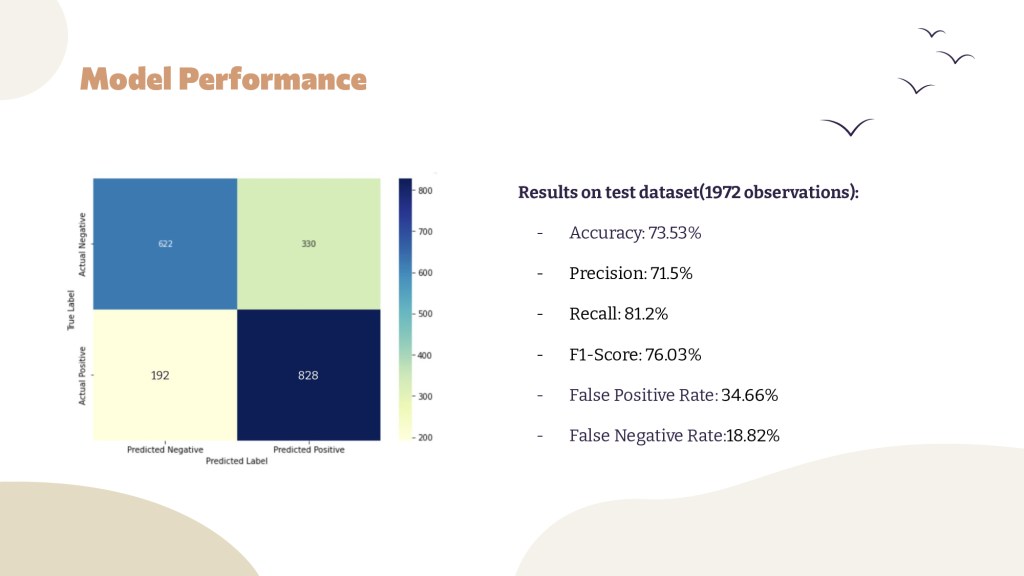

- Validation and Performance Metrics: We validated the model’s performance, achieving an accuracy of 73.53% on the validation set, and detailed the influence of various predictors using coefficient analysis.

User Interface

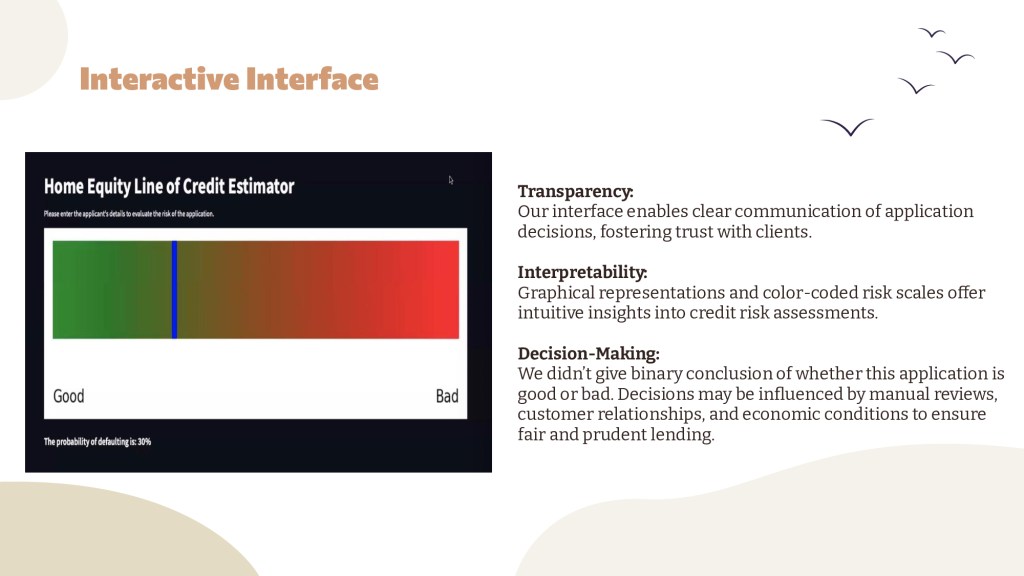

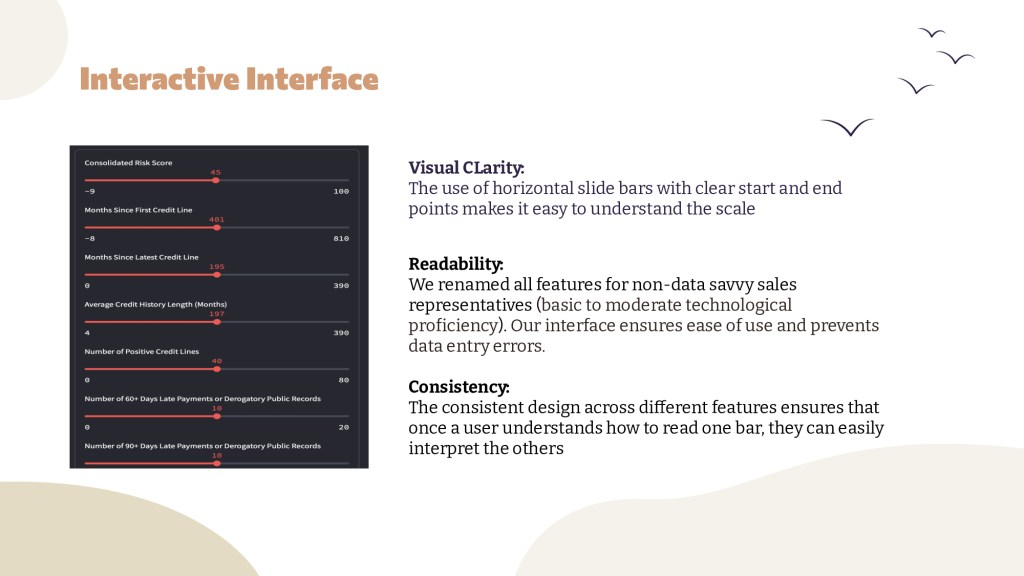

To make the model accessible to non-technical end-users, we developed an intuitive interface using Streamlit. This interface allows users to input applicant data and receive predictions instantly, with the following features:

- Interactive Visualizations: Using Matplotlib and Seaborn, we created visual representations of risk estimates versus default probabilities, aiding in understanding the underlying model predictions.

- Real-time Predictions: The interface provides immediate feedback on the risk associated with each application, enabling faster and more informed decision-making.

Limitations

Our logistic regression model for predicting HELOC risk has several limitations:

- Model Linearity: It fails to capture more complex, nonlinear relationships between variables, which might limit its predictive power in certain scenarios.

- Sensitivity to Outliers: The model’s performance is highly sensitive to outliers, affecting its stability and accuracy.

- Accuracy: While achieving an accuracy of 73.53%, there’s still room for improvement to reduce potential errors.

- False Positive Rate (FPR): With a FPR of 34%, the model misclassifies a significant number of non-defaulters as defaulters, which could lead to potential revenue loss.

- Human Intervention: Certain cases require manual intervention to verify the model’s predictions, indicating that the model cannot entirely replace human decision-making.

- Predictive Reliability: The model’s predictions are based on current and historic trends, which might not accurately predict future behavior as market conditions evolve.

These limitations highlight the need for continuous model evaluation and potential integration of more complex algorithms to enhance predictive accuracy and reliability.

Conclusion

By integrating cutting-edge data analytics and user-friendly interface design, we provide a tool that not only predicts HELOC risks with high accuracy but also empowers financial professionals to make better-informed decisions.

Leave a comment